How we de-risked a GenAI chatbot

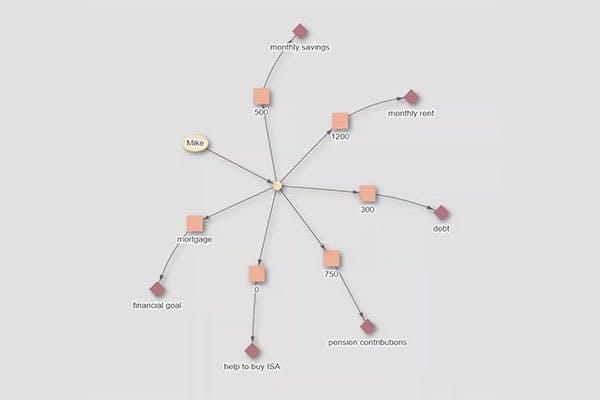

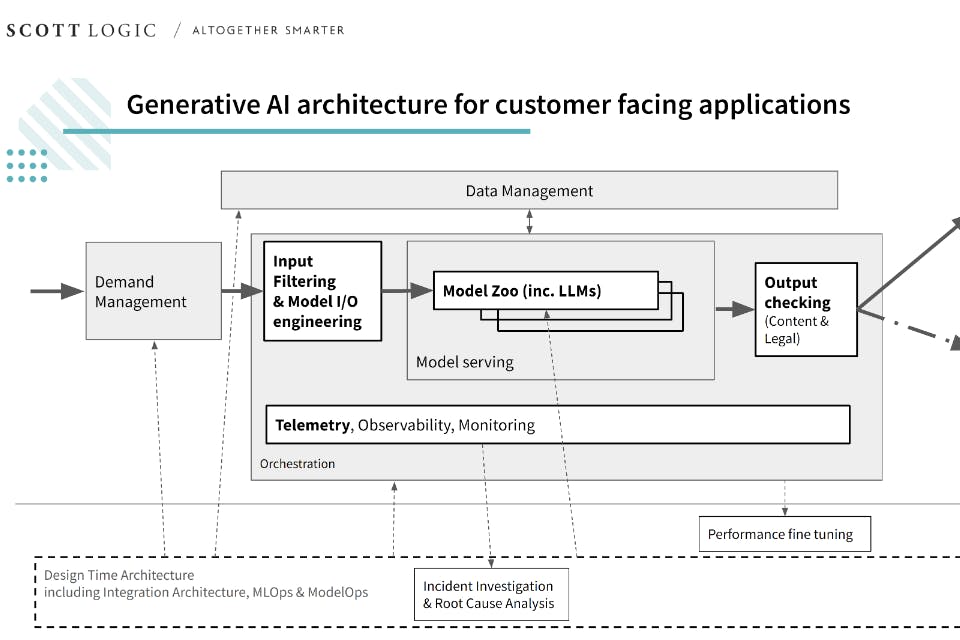

Simon Hamilton Ritchie was part of a Scott Logic team that developed and delivered a Proof of Concept for a major retail bank, which demonstrated high potential business value and showed how GenAI could be reined in using a Knowledge Graph. In this post, he provides an overview of how it worked.

Simon Hamilton Ritchie